Compliance-Ready Personalized Reports: Auditable Analysis with Client-Tailored Communication

High-net-worth clients demand personalized, sophisticated analysis—but most AI tools produce black-box outputs compliance officers can't verify. VelocityIQ solves this with glass-box architecture: every number is auditable, every calculation transparent, while the presentation is deeply personalized. Compliance-ready meets client-ready.

VelocityIQ generates personalized reports with full audit trail and calculation transparency. Advisors remain responsible for reviewing reports, verifying accuracy, and making all professional determinations before client delivery.

HNWIs Want Personalization. Compliance Needs Transparency. Most AI Can't Deliver Both.

What Research Shows HNWIs Expect

79% of younger HNWIs want AI-powered advisory tools

35% would switch advisors if technology capabilities lag behind

93% of RIAs planning to adopt AI in next 12-18 months

But HNWIs specifically demand:

- • Sophisticated, personalized analysis (not generic templates)

- • Communication that reflects their unique situation

- • Insights tailored to their business, industry, goals

- • Explanations at appropriate depth for their sophistication

- • Reports that demonstrate deep understanding of their context

Source: Boosted.ai/InvestmentNews HNWI Survey 2024, RFI Global Private Banking 2025

The Market Reality:

Business-owning HNWIs are sophisticated clients who:

- • Run complex businesses—they understand nuance and context

- • Expect professional-grade analysis equal to what they receive in business

- • Can tell immediately if analysis is generic vs. truly personalized

- • Value advisors who demonstrate deep understanding of their situation

- • Will pay premium fees for genuinely customized service

Black-Box AI Creates Unacceptable Compliance Risk

Why most AI tools are unusable:

Unverifiable Calculations

- AI produces numbers but doesn't show how they were calculated

- Compliance officer can't verify accuracy

- In regulatory exam, can't demonstrate where numbers came from

- If challenged, can't defend the analysis methodology

Hallucination Risk

- AI can generate plausible-sounding but factually incorrect information

- May cite non-existent sources or regulations

- Can create "facts" that sound credible but aren't verifiable

- Compliance officer has no way to catch fabrications without manual fact-checking

No Audit Trail

- Can't recreate how AI arrived at conclusions

- No documentation of decision-making process

- Can't show systematic methodology to regulators

- If client challenges recommendation, no defensible record

Attribution Problems

- Factual statements without source citations

- Can't verify where information came from

- Compliance can't assess reliability of sources

- Opens firm to liability for inaccurate information

The Compliance Officer's Nightmare:

"The AI-generated report looks great and clients love it, but I have no idea if the numbers are correct, where the facts came from, or how to defend this in an audit. I can't approve something I can't verify—which means we can't use AI for personalization, which means we can't compete for sophisticated HNWIs who expect it."

Result: Platforms caught between client demands and compliance requirements.

Caught Between Client Expectations and Compliance Reality

The Impossible Choice:

Option A: Generic Reports

Compliance-Safe, Client-Unsatisfying

BUT:

Option B: AI-Personalized Reports

Client-Delighting, Compliance-Risky

BUT:

The Market Impact:

Platforms that can't solve this paradox will:

- • Lose sophisticated HNWI clients to competitors who can

- • Fail to attract top advisors who want to serve high-value clients

- • Miss the 1-1.5M business-owning HNWI market opportunity

- • Fall behind in technology arms race for advisor talent

- • See AUM concentration shift to platforms with better technology

Why This Matters Urgently:

- • 93% of RIAs planning AI adoption in next 12-18 months

- • Platforms need solutions that work NOW, not promises

- • Every month without compliant personalization is lost competitive ground

The Only Platform That Delivers Both Compliance Rigor and HNWI-Grade Personalization

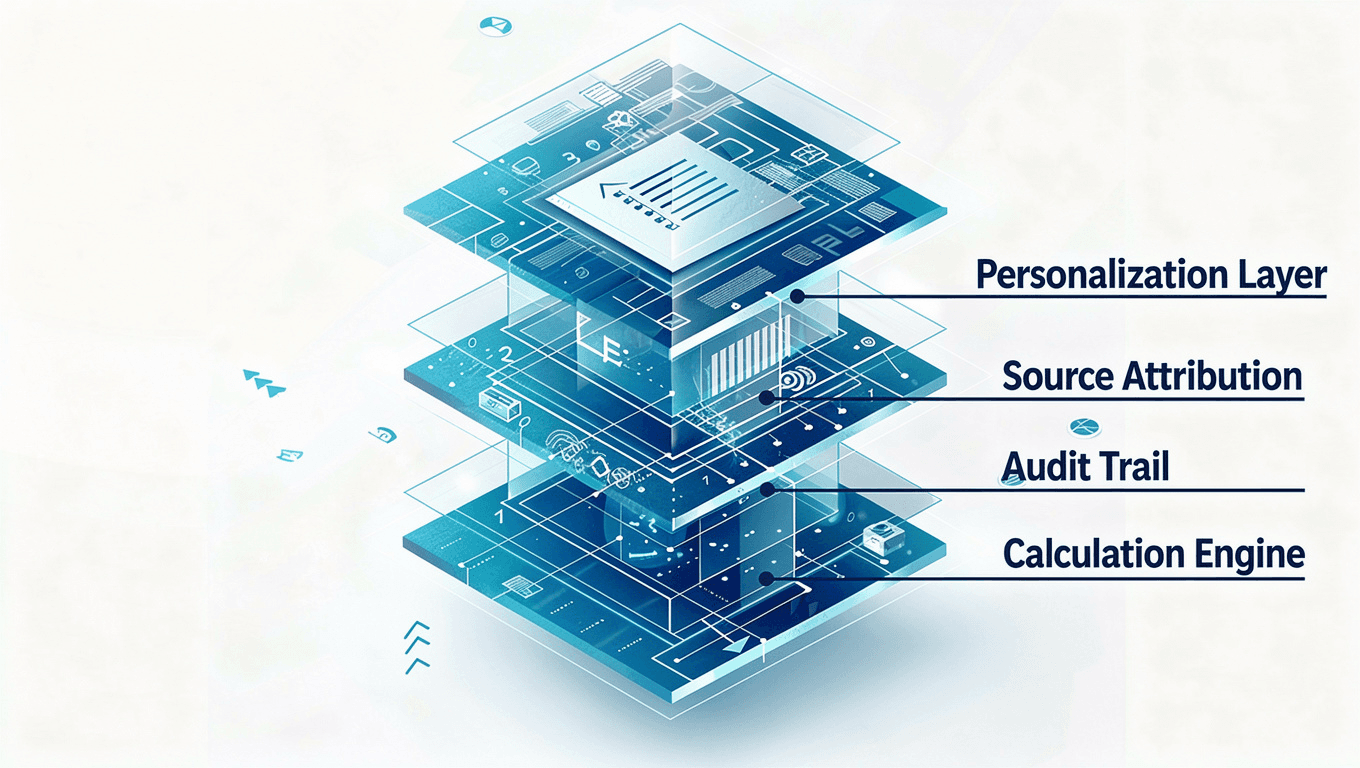

VelocityIQ solves the paradox with glass-box architecture that separates WHAT is calculated from HOW it's communicated:

Layer 1: Deterministic Calculation Engine

Compliance-Ready- → All math done with explicit, verifiable formulas

- → Every number shows its calculation

- → Complete audit trail of inputs and processes

- → Zero black-box calculations

Layer 2: Source Attribution System

Fact-Verifiable- → 2-3 citations per factual statement

- → All sources referenced and checkable

- → No AI hallucinations possible in facts

- → Compliance can verify every claim

Layer 3: Audit Trail Infrastructure

Exam-Ready- → Complete documentation of analysis process

- → Timestamp and version control

- → Decision points documented

- → Supports regulatory examination defense

Layer 4: Personalization Layer

Client-Tailored- → AI personalizes HOW analysis is communicated

- → Adapts language, tone, examples to client

- → References client context and situations

- → Creates exceptional client experience

WHILE MAINTAINING:

- → Full calculation transparency (Layer 1)

- → Factual verifiability (Layer 2)

- → Audit defensibility (Layer 3)

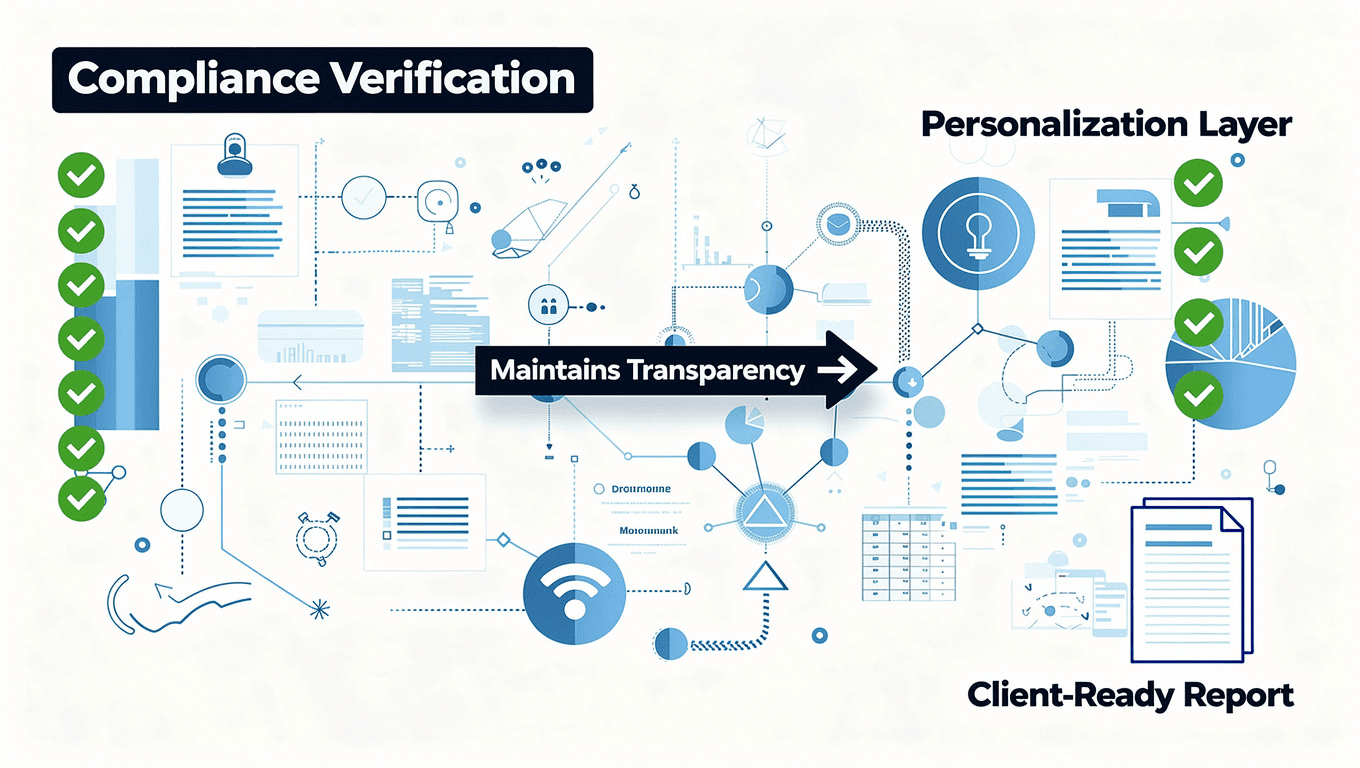

Auditable Foundation, Personalized Presentation

Compliance-Ready Analysis Generation

What Happens:

System generates base analysis with full transparency:

- • All calculations performed with explicit formulas

- • Every number shows: [Input Values] → [Formula] → [Result]

- • All factual statements attributed to verifiable sources

- • Complete audit trail of analysis process

- • All data anomolies require human review - no silent errors

- • Zero black-box operations

Compliance Officer Can Verify:

- ✓ Where every number came from

- ✓ How every calculation was performed

- ✓ Source of every factual statement

- ✓ Systematic methodology applied

- ✓ Decision points and logic

- Options exercised: 500,000

- Strike price: $0.50/share

- Fair market value: $1.40/share

- Filing status: Married Filing Jointly

- AMT exemption (2025): $133,300 [Source: IRS Rev. Proc. 2024-40]

- AMT rate: 28% [Source: IRC §55(b)(1)(A)(ii)]

Compliance Value:

Every number is defensible. Every fact is sourced. Every calculation can be verified in seconds.

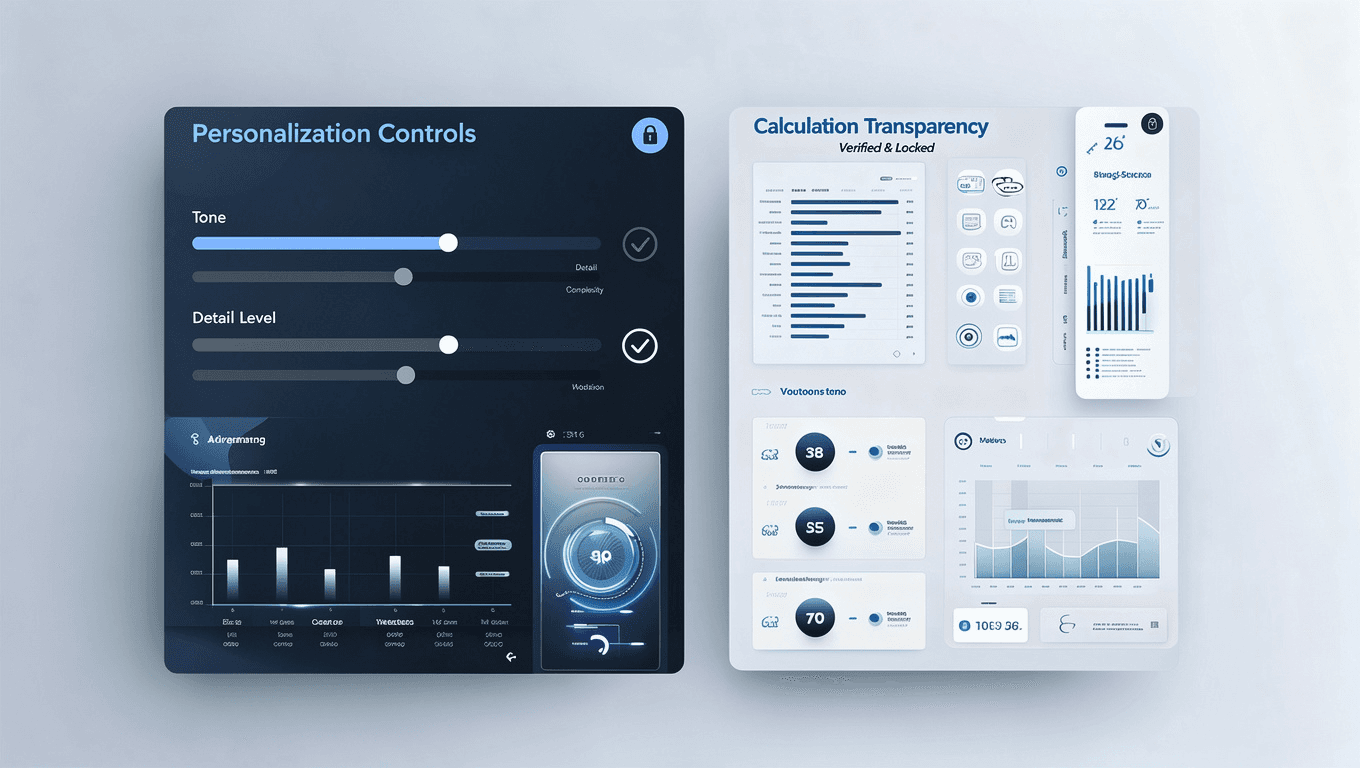

Personalization Layer Applied

What Happens:

AI personalizes HOW the analysis is communicated to THIS client:

- • Adjusts language complexity to client sophistication

- • References client's specific situation and context

- • Uses analogies relevant to client's business/experience

- • Matches tone to how advisor and client communicate

- • Organizes information around client's priorities

WHILE PRESERVING:

- • All calculation transparency

- • All source attribution

- • Complete audit trail

- • Verifiable accuracy

You asked about exercising 500,000 of your ISOs before your company's IPO next year. Here's the tax situation you'll want to understand:

When you exercise at $0.50 per share while the company valuation puts fair market value at $1.40, the IRS sees that $0.90 difference as taxable income—even though you haven't sold the stock yet. This triggers the Alternative Minimum Tax.

Think of AMT as the IRS's backup system to ensure you pay some tax even when using strategies (like ISO exercises) that defer regular income tax. For your situation:

- Your bargain element: $450,000 ($0.90 × 500,000 shares)

- After AMT exemption: $316,700 subject to AMT

- AMT liability: approximately $88,676

[Complete calculation details available in filtered audit reports]

This is roughly what you mentioned spending on your last two product development cycles—meaningful but manageable given your company's cash position. The trade-off is locking in your QSBS eligibility now, which could save you $10M+ in capital gains taxes at exit, as we discussed in our last meeting.

Given your IPO timeline of 12-18 months and your stated goal of minimizing tax drag on wealth building for your kids' futures, we should consider whether paying ~$89K now is worthwhile to protect the potential QSBS exclusion.

What Changed:

- ✓ Conversational, client-appropriate language

- ✓ References to actual client situation (IPO timeline, product development costs)

- ✓ Connection to client goals (kids' futures, minimizing tax drag)

- ✓ Analogies from client's business context

- ✓ Acknowledges previous conversation

- ✓ Offers next steps

What Didn't Change:

- ✓ The $88,676 calculation (still 100% accurate and verifiable)

- ✓ Source attribution (still cited to IRS guidance)

- ✓ Audit trail (complete documentation maintained)

- ✓ Compliance defensibility (all numbers still transparent)

Advisor Review and Approval

Advisor Can Review:

Compliance View

- → All calculations with formulas

- → Source citations for all facts

- → Audit trail documentation

- → Verify accuracy and defensibility

Client View

- → Personalized narrative presentation

- → Language and tone appropriateness

- → Contextual references accuracy

- → Overall client communication quality

Toggle Between Views:

- → See compliance layer anytime

- → Verify personalization accuracy

- → Ensure both layers align

- → Approve when satisfied

Advisor Responsibilities:

- → Review both compliance and client views

- → Verify accuracy of all numbers and facts

- → Confirm personalization appropriate for this client

- → Ensure client context references are correct

- → Make any needed adjustments

- → Approve before client delivery

- → Take responsibility for all content

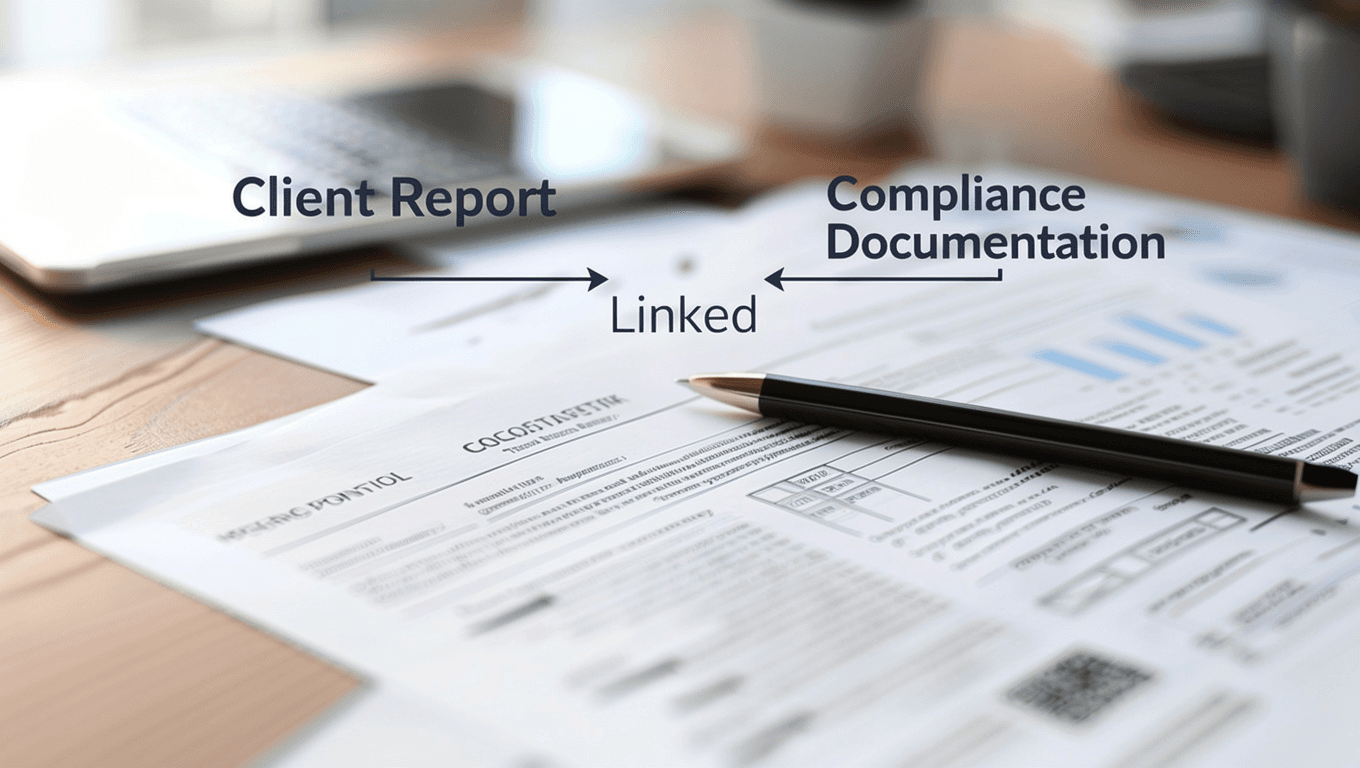

Dual-Track Documentation

Client-Facing Report

- • Personalized narrative presentation

- • Client-appropriate language and tone

- • Contextual examples and analogies

- • Organized around client priorities

- • Professional, engaging format

- • Filtered audit reports available for calculation details

Compliance Documentation (Parallel)

- • All calculations with transparent formulas

- • Complete source attribution

- • Audit trail of analysis process

- • Systematic methodology documentation

- • Timestamp and version control

- • Advisor review and approval records

Report Output Options:

- • Generate official PDF client report

- • Export filtered audit reports to PDF

- • Generated validation warnings, FINRA 2111 tests and residual risk reports are also outputted to a text file as standard

- • Print compliance documentation for files

- • Archive scenarios for client reference

Filtered Audit Reports Available:

- → FINRA 2111 Suitability Analysis calculations

- → Risk identification (73 rules) details

- → AML assessment methodology

- → Source attribution report

- → Complete number audit

Filter by section to view specific analysis components. Print or save each audit report to PDF.

For Regulatory Examinations:

Examiner asks: "How did you determine this was suitable?"

Advisor shows:

- Personalized client report (what client received)

- Underlying compliance documentation (how determination was made)

- Audit trail showing systematic process

- All calculations and sources verifiable

Result: Demonstrates both client service quality AND compliance rigor

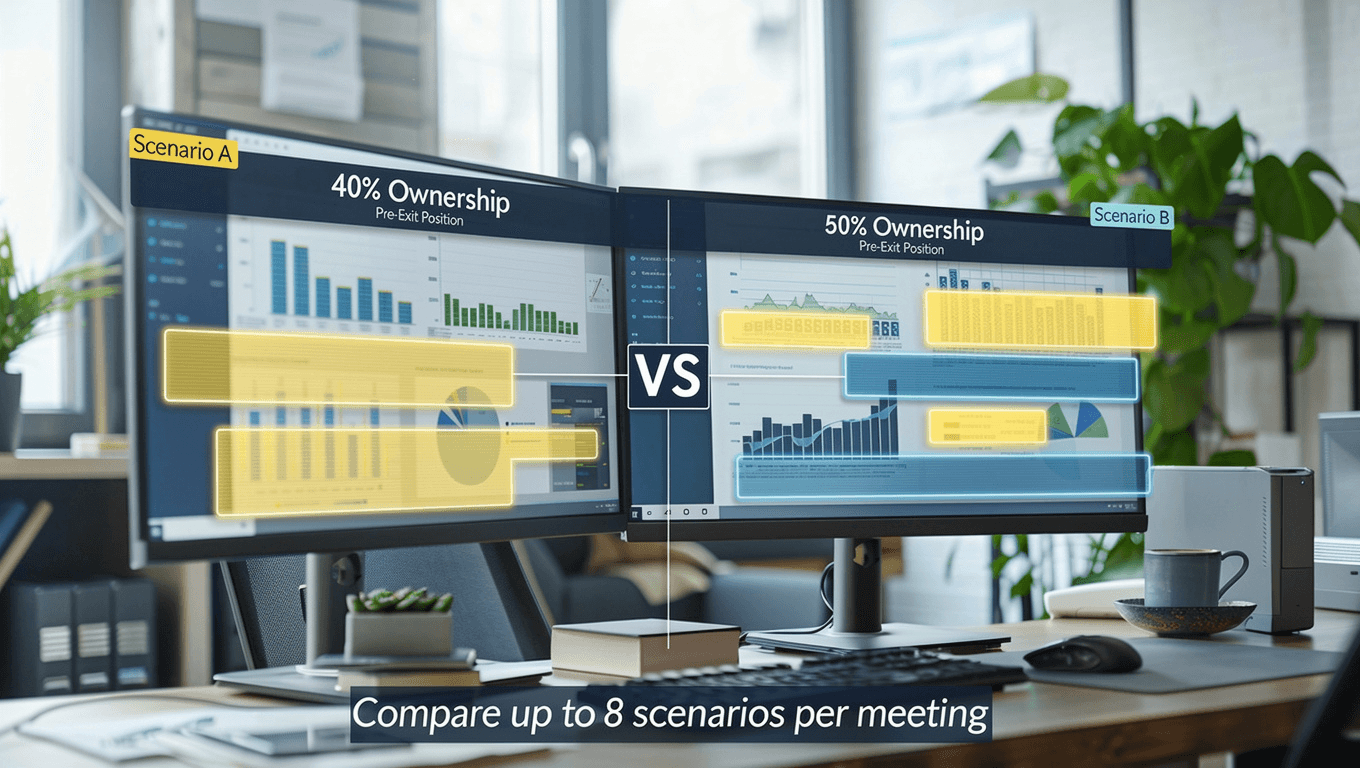

Real-Time Scenario Comparison During Client Meetings

Explore multiple strategies with your client in real-time during meetings. Generate side-by-side scenario comparisons in 40 seconds, each maintaining full compliance transparency and personalization.

Scenario Generation Capability

- ✓ Generate new scenarios in 40 seconds

- ✓ Up to 8 scenarios per meeting

- ✓ Each scenario fully personalized

- ✓ Complete compliance transparency maintained

- ✓ Side-by-side comparison view

Example Scenario Questions

- • "What if client increased ownership from 40% to 50% before exit?"

- • "How would exercising ISOs in tranches across two tax years affect AMT?"

- • "What's the impact of delaying exit by 12 months?"

- • "Compare QSBS eligibility under different exit structures"

Meeting Workflow:

- Generate base scenario during client meeting

- Client asks "what if" question

- Generate comparison scenario in 40 seconds

- Display side-by-side comparison on screen

- Both scenarios maintain full audit trail

- Export both scenarios to PDF for client

Key Benefits:

- ✓ Explore multiple strategies with client in real-time

- ✓ Demonstrate sophisticated analysis capabilities during meetings

- ✓ Each scenario maintains full calculation transparency

- ✓ All scenarios documented for compliance files

- ✓ Export comparison reports to PDF for client delivery

"Finally, AI Personalization I Can Actually Approve"

What Compliance Officers Get:

Full Verifiability

- ✓ Can verify every calculation in seconds

- ✓ Can check source of every factual statement

- ✓ Can review complete audit trail

- ✓ Can demonstrate systematic methodology

- ✓ Can defend in regulatory examinations

Risk Mitigation

- ✓ No black-box calculations creating liability

- ✓ No AI hallucinations in factual content

- ✓ No unattributed claims to defend

- ✓ No mysterious numbers that can't be explained

- ✓ No compliance risk from advisor-delighting features

Exam Readiness

- ✓ Documentation demonstrates systematic approach

- ✓ Can show exactly how determinations were made

- ✓ Can verify accuracy of all analysis

- ✓ Can defend client communications

- ✓ Passes regulatory scrutiny while delivering great client experience

"For years, we've had to choose between generic reports compliance could verify and personalized reports clients wanted. VelocityIQ finally gives us both. I can verify every number, check every source, and audit the complete process—while advisors deliver the sophisticated, personalized experience HNWIs expect. This is the breakthrough we've needed."

— Chief Compliance Officer perspective

Now You Can Deliver What HNWIs Demand—Without Compliance Risk

What HNWIs Experience:

Sophisticated Personalization

- ✓ Analysis that reflects deep understanding of their situation

- ✓ Communication at appropriate sophistication level

- ✓ References to their business, industry, specific concerns

- ✓ Analogies from their experience that resonate

- ✓ Tone that matches how they think and communicate

- ✓ Demonstrates advisor has truly listened and understood

Professional-Grade Analysis

- ✓ Comprehensive evaluation of their complex situation

- ✓ Nuanced consideration of business-specific factors

- ✓ Tax implications explained with depth and clarity

- ✓ Risk analysis relevant to their wealth level

- ✓ Strategic thinking that matches their business acumen

Transparency and Confidence

- ✓ Can access filtered audit reports for calculation details

- ✓ Can verify sources of factual information

- ✓ Can understand exactly how analysis was performed

- ✓ Builds confidence in advisor's systematic approach

- ✓ Sophisticated enough to appreciate the rigor

Example - What Business Owner Sees:

"This isn't a template with my name plugged in. This advisor clearly understands my business model, knows my industry challenges, and is thinking about my specific situation. The analysis references our conversation about the supply chain issues we discussed, uses examples from my manufacturing experience, and even remembers what I said about my timeline for semi-retirement.

And when I clicked through on the AMT calculation, I could see exactly how they arrived at the number—it's all there, transparent and verifiable. That level of both personalization AND rigor is what I expect from professionals I'm paying to manage my wealth."

Better Client Discovery → Richer Documentation → More Personalized Reports

What Advisors Provide (Input to Personalization)

Required Investment Profile Data

- • Standard FINRA nine factors

- • Financial situation and goals

- • Business and tax information

- • Risk tolerance and time horizon

[This is required for compliance analysis regardless]

Optional Client Context

The Personalization Multiplier

Communication Profile

- • Client's sophistication level with financial concepts

- • Preferred communication style (technical vs. conversational)

- • Areas where client needs more education vs. grasps quickly

- • How client makes decisions (detail-oriented vs. big-picture)

Business and Industry Context

- • Client's industry and how their business operates

- • Specific business challenges they've mentioned

- • Company growth stage and strategic plans

- • Unique aspects of their business model

Personal Context and Goals

- • Family dynamics relevant to planning

- • Specific concerns client has expressed

- • Legacy intentions and values

- • Life transitions or timeline factors

Conversation History

- • Topics discussed in previous meetings

- • Questions client has asked

- • Analogies or examples that have resonated

- • Decisions client is working through

The Quality Equation:

Minimum profile data

→ Technically accurate, compliance-ready, but generic presentation

Rich profile + client context

→ Technically accurate, compliance-ready, AND highly personalized presentation

The more client insights you document, the better the personalization—but compliance rigor is maintained regardless.

Your Competitive Advantage:

Every advisor using VelocityIQ has access to the same analysis tools and personalization engine. Your differentiation comes from the quality of your client relationships.

Advisors who invest in deeper discovery conversations, practice active listening, and document richer client insights will produce more valuable, highly personalized reports. The platform amplifies your relationship skills—it doesn't replace them.

Better relationships → Better insights → Better reports → Stronger client loyalty

What Advisors Control

Tone and Complexity

- → Technical/Professional/Conversational spectrum

- → Detail level (executive summary to comprehensive)

- → Complexity matching client sophistication

- → Analogy usage (frequent, moderate, minimal)

Content Organization

- → What to emphasize based on client priorities

- → Order of presentation (most important to client first)

- → How much detail on different topics

- → Which risks to highlight prominently

Personalization Depth

- → How much client context to include

- → References to previous conversations

- → Industry-specific analogies and examples

- → Personal situation mentions

Report Management

- → Generate multiple scenarios for comparison

- → Filter audit reports by analysis component

- → Export reports to PDF for client delivery

- → Print compliance documentation for files

- → Archive scenarios for client reference

The Critical Point

Advisors control personalization presentation. Compliance controls calculation accuracy. Both are maintained simultaneously.

Advisor can adjust how analysis is communicated. Advisor cannot change underlying calculations or sources. This preserves compliance rigor while enabling personalization.

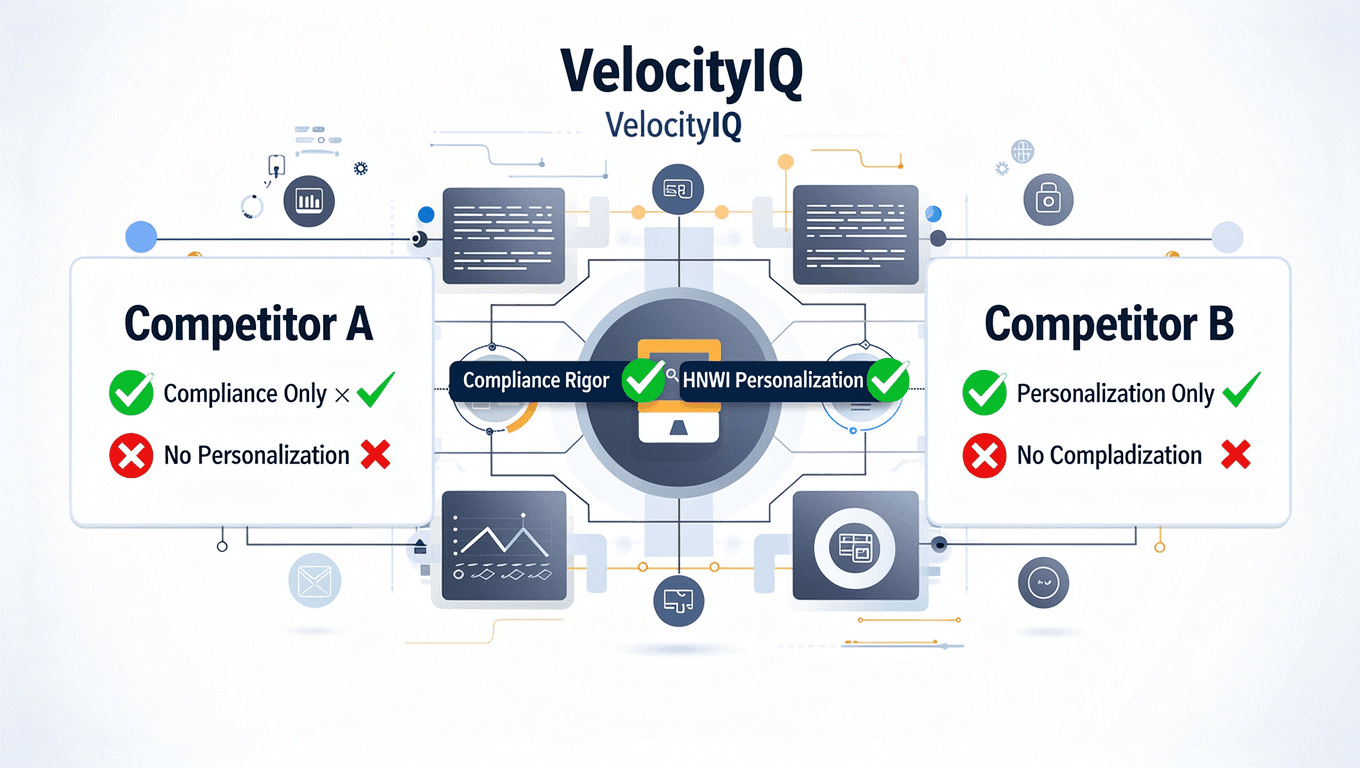

The Only Platform That Solves Both Sides of the Equation

The Competitive Landscape

Traditional Compliance-Focused Tools

Pros:

- Calculations verifiable

- Audit trail complete

- Compliance officer approves

Cons:

- Generic, template-driven reports

- No personalization capability

- Can't compete for sophisticated HNWIs

- Advisors see them as "compliance burden" not client value

Black-Box AI Personalization Tools

Pros:

- Highly personalized output

- Impressive client experience

- Advisors love them

Cons:

- Calculations unverifiable

- Hallucination risk

- Compliance can't approve

- Regulatory examination risk

VelocityIQ Unique Position

Compliance-Ready:

- Fully verifiable calculations

- Complete source attribution

- Audit trail documentation

- Glass-box transparency

AND SIMULTANEOUSLY:

- Sophisticated personalization

- Client-tailored communication

- Context-aware presentation

- Exceptional client experience

NO OTHER PLATFORM DELIVERS BOTH.

Why RIA Platforms Need This Capability Now

For Platforms

Competitive Requirements

The 1-1.5M business-owning HNWI market demands:

- → Sophisticated, personalized analysis

- → Technology-enabled advisor capabilities

- → Professional-grade client experiences

Platforms without compliant personalization will:

- Lose sophisticated clients to competitors

- Fail to attract top advisors

- Miss the highest-value market segment

- Fall behind in technology arms race

The VelocityIQ Platform Advantage

- Differentiate with HNWI-grade client experience

- Maintain full compliance rigor and exam readiness

- Attract advisors who want to serve complex clients

- Compete for highest-value market segment

- Future-proof with AI capabilities compliance approves

For Advisors

The Market Opportunity

Business-owning HNWIs (1-1.5M market) will choose advisors who can:

- → Demonstrate deep understanding of their situation

- → Deliver sophisticated, personalized analysis

- → Use technology to provide better service

- → Maintain professional rigor and documentation

What VelocityIQ Enables

- Deliver exceptional personalized client experiences

- Compete for sophisticated, high-value clients

- Differentiate from advisors using generic tools

- Build stronger relationships through better communication

- Scale personalization that used to take hours per client

- Do it all with compliance confidence

For Compliance Officers

The Solution to the Paradox

Finally approve AI personalization without creating risk:

- Every calculation verifiable

- Every fact source-attributed

- Complete audit trail maintained

- Systematic methodology documented

- Regulatory examination defensible

WHILE enabling:

- Advisor competitiveness for HNWIs

- Platform differentiation in market

- Client experience that drives growth

- Technology adoption with confidence

Understanding Personalized Reports and Advisor Accountability

What Personalized Reporting Provides

- ✓ Glass-box calculation transparency

- ✓ Complete source attribution

- ✓ Full audit trail documentation

- ✓ AI-powered presentation personalization

- ✓ Client-tailored communication formatting

What Personalized Reporting Does NOT Do

- Make suitability determinations or recommendations

- Replace advisor professional judgment

- Eliminate need for advisor review

- Guarantee accuracy of personalization

- Reduce advisor responsibility for content

Advisor Responsibilities

You are solely responsible for:

- → Accuracy of all client information provided

- → Appropriateness of personalization for each client

- → Reviewing and verifying all report content

- → Approving reports before client delivery

- → Ensuring recommendations reflect your determinations

- → Compliance with firm policies and regulations

- → All content delivered to clients

- → Professional quality of all communications

VelocityIQ generates personalized report presentations with transparent calculations and source attribution. VelocityIQ does not make investment recommendations or provide advice. Advisors must review all reports, verify accuracy of calculations and personalization, ensure appropriateness, and approve content before client delivery. Advisors are solely responsible for all report content, recommendations made, and compliance with applicable regulations.

Reports are provided "as is" and may contain errors despite transparency measures. VelocityIQ disclaims liability for report content, advisor use of reports, client outcomes, or damages arising from report generation or delivery.

Use of personalized reporting does not ensure accuracy, regulatory compliance, or eliminate advisor liability for report content and client communications.

Deliver HNWI-Grade Personalization With Compliance Confidence

See how VelocityIQ solves the AI personalization paradox—delivering sophisticated, client-tailored reports with full calculation transparency, source attribution, and audit trail documentation. The only platform that gives compliance officers AND HNWIs what they demand.

VelocityIQ provides glass-box personalization with full compliance transparency. Advisors review, verify, and approve all content before client delivery.