FinCEN-Aligned AML Risk Assessment Framework: Supporting Your Due Diligence Process

VelocityIQ provides structured AML risk analysis tools aligned with FinCEN guidelines— helping you evaluate client financial crime risk across multiple dimensions. You apply professional judgment to assessment results and determine appropriate CDD/EDD actions.

Legal Notice:

VelocityIQ provides AML risk analysis tools and frameworks. Advisors and compliance professionals are solely responsible for making final AML risk assessments, determining appropriate due diligence levels, and complying with all AML/BSA requirements.

Decision-Support for Customer Due Diligence Obligations

The Regulatory Requirement:

Financial institutions must assess customer risk for anti-money laundering and financial crime exposure as part of Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) requirements.

The Challenge:

Manual AML risk assessment is:

- • Time-consuming and inconsistent

- • Difficult to document systematically

- • Hard to scale across client base

- • Challenging to update as situations change

How VelocityIQ Supports This:

Structured risk assessment framework that:

- → Evaluates clients across 7 risk dimensions

- → Calculates risk scoring for your review

- → Maps scores to risk tier framework

- → Suggests CDD/EDD considerations

- → Documents analysis for your AML file

You review the analysis, apply your judgment, and make final risk determination.

Your Responsibilities:

- ✓ Review system-generated risk analysis

- ✓ Consider additional factors not captured

- ✓ Make final AML risk assessment

- ✓ Determine appropriate due diligence level (CDD/EDD)

- ✓ Implement required due diligence procedures

- ✓ Document your risk assessment and actions

- ✓ Monitor client risk on ongoing basis

- ✓ Report suspicious activity as required

- ✓ Comply with all AML/BSA regulations

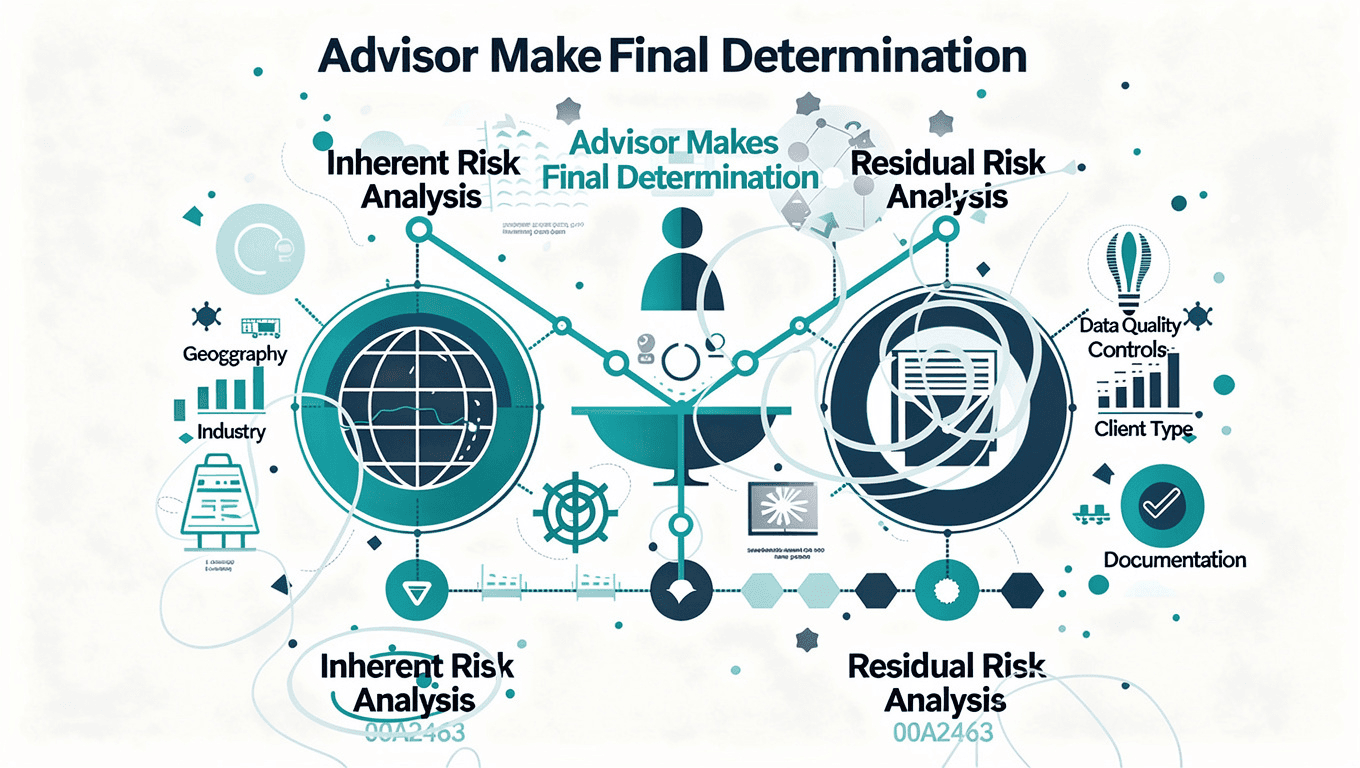

Two Complementary Risk Scores for Your Assessment

Score 1: Inherent Risk Analysis

What It Analyzes:

Baseline risk level based on client characteristics:

- • Geographic exposure (country-based risk)

- • Industry sector (business activity risk)

- • Client type (entity structure complexity)

- • Product/service complexity

- • Source of wealth transparency

- • PEP (Politically Exposed Person) status

- • Adverse media presence

How Scoring Works:

Each dimension scored 1 (lower risk) to 5 (higher risk)

Scores aggregated for total inherent risk score

Provides baseline risk profile for your assessment

Your Use:

- → Review inherent risk score and component factors

- → Consider whether scoring reflects your understanding

- → Assess if additional factors should be considered

- → Use as starting point for your risk determination

Score 2: Residual Risk Analysis

What It Considers:

Adjusted risk after accounting for:

- • Data quality and completeness

- • Validation rule outcomes

- • Documentation availability

- • Control effectiveness

How Adjustment Works:

System evaluates:

- → If data quality controls passed (may reduce residual risk)

- → If critical validation issues identified (may increase residual risk)

- → Documentation completeness and quality

- → Overall control environment effectiveness

Provides adjusted risk score for your assessment

Your Use:

- → Review how controls affected risk scoring

- → Assess whether adjustments are appropriate

- → Consider additional control factors

- → Use as input to your final risk determination

Critical Clarification:

- • System provides risk scoring analysis.

- • You determine whether scores accurately reflect client risk.

- • You make final AML risk assessment.

- • You determine appropriate due diligence level.

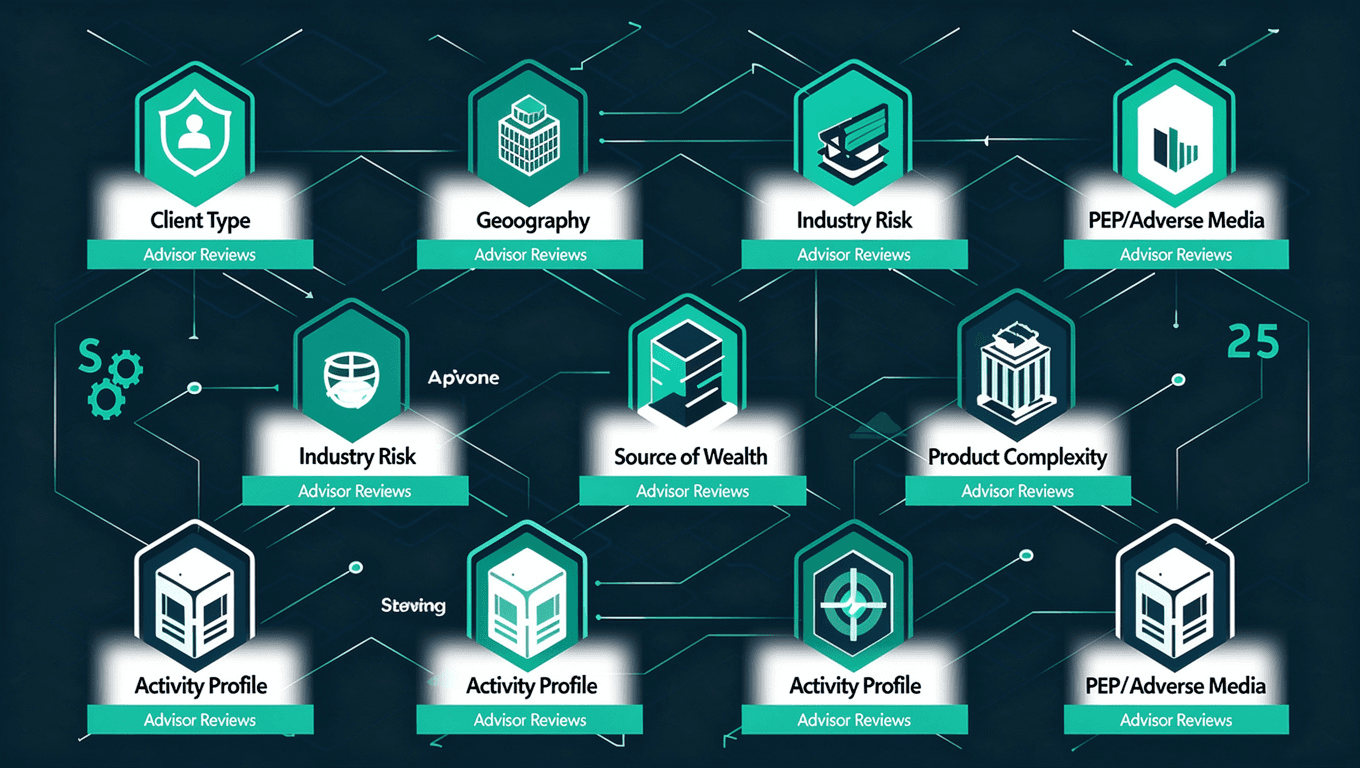

Comprehensive Risk Factor Analysis Framework

Dimension 1: Client Type

Analysis considers:

- • Individual vs. business entity

- • Private company vs. public company

- • High-risk business classifications

- • Regulated financial institution status

For your assessment:

- → Review classification accuracy

- → Consider entity complexity factors

- → Assess ownership transparency

- → Determine appropriate documentation needs

Dimension 2: Geographic Risk

Analysis considers:

- • Country/jurisdiction exposure

- • Risk ratings for countries involved

- • Cross-border transaction patterns

For your assessment:

- → Verify geographic exposure accuracy

- → Consider additional jurisdictions

- → Assess transaction pattern implications

- → Determine enhanced monitoring needs

Current: US-focused (framework ready for international expansion)

Dimension 3: Industry Risk

Analysis categorizes industries as:

- • Lower risk (professional services, technology)

- • Medium risk (real estate, luxury goods)

- • Higher risk (cash-intensive, cryptocurrency, certain high-risk sectors)

For your assessment:

- → Confirm industry classification

- → Consider specific business activities

- → Assess actual risk vs. industry category

- → Determine sector-appropriate due diligence

Dimension 4: Source of Wealth

Analysis evaluates:

- • Transparency of wealth sources

- • Documentation quality and completeness

- • Clarity of income/asset origins

For your assessment:

- → Review documentation adequacy

- → Determine if additional documentation needed

- → Assess transparency and plausibility

- → Decide on appropriate verification level

Dimension 5: Product/Service Complexity

Analysis considers:

- • Types of products/services used

- • Complexity level (simple to complex)

- • Risk characteristics of offerings

For your assessment:

- → Verify product usage accuracy

- → Consider complexity implications

- → Assess appropriateness for client type

- → Determine monitoring approach

Dimension 6: Activity Profile

Analysis evaluates:

- • Transaction patterns and frequency

- • Volume and size characteristics

- • Geographic distribution

- • Unusual activity indicators

For your assessment:

- → Review pattern analysis

- → Assess if patterns are reasonable

- → Identify any unusual characteristics

- → Determine appropriate monitoring level

Dimension 7: PEP/Adverse Media

Analysis flags:

- • Politically Exposed Person status

- • Negative media coverage

- • Sanctions list presence

- • Regulatory action history

For your assessment:

- → Verify PEP status accuracy

- → Review adverse media findings

- → Assess significance of issues

- → Determine enhanced due diligence needs

Current: Requires manual input (framework ready for automated screening integration)

Your Professional Judgment Required:

- • System provides analysis across dimensions.

- • You assess whether analysis accurately reflects client risk.

- • You consider factors not captured by system.

- • You make final risk determination for each dimension.

- • You determine overall client risk assessment.

Suggested Risk Classification for Your Assessment

System maps risk scores to suggested tier framework. You review suggested tier and make final determination.

Lower Risk Tier

(Suggested for scores 0-8)

Typical Characteristics:

- • Domestic operations, transparent industries

- • Simple products, clear wealth sources

- • No PEP/adverse media concerns

- • Strong documentation

CDD/EDD Considerations for Your Review:

- → Standard Customer Due Diligence may be appropriate

- → Annual review cadence may be sufficient

- → Standard documentation requirements

- → Normal monitoring procedures

You determine actual due diligence requirements based on your assessment.

Medium Risk Tier

(Suggested for scores 9-16)

Typical Characteristics:

- • Some elevated risk factors present

- • Industry or activity requires attention

- • Geographic considerations

- • Documentation adequate but with gaps

CDD/EDD Considerations for Your Review:

- → Enhanced monitoring may be appropriate

- → More frequent review cadence (semi-annual/quarterly) may be warranted

- → Additional documentation may be advisable

- → Increased scrutiny of transactions may be appropriate

You determine actual due diligence requirements based on your assessment.

Higher Risk Tier

(Suggested for scores 17+)

Typical Characteristics:

- • Multiple elevated risk factors

- • High-risk industry or jurisdiction

- • PEP involvement or adverse media

- • Complex structures or unclear sources

CDD/EDD Considerations for Your Review:

- → Enhanced Due Diligence likely required

- → Senior management approval may be needed

- → Intensive ongoing monitoring may be appropriate

- → Comprehensive documentation likely needed

- → Frequent review cadence (quarterly or more) may be warranted

- → Consider whether relationship can be managed within risk appetite

You determine actual due diligence requirements based on your assessment.

Critical Notice:

- • System suggests risk tier based on scoring analysis.

- • You determine whether suggested tier is appropriate.

- • You make final risk classification.

- • You determine appropriate due diligence level.

- • You implement required due diligence procedures.

- • You remain responsible for all AML compliance decisions.

Contextual Risk Insights for Your Consideration

What AI Analysis Provides:

System generates contextual analysis including:

- • Plain-language interpretation of risk scoring

- • Key risk drivers identified

- • Risk mitigation considerations

- • Monitoring approach suggestions

- • Factors warranting attention

Example AI Analysis Output:

AI RISK ANALYSIS (For Advisor Review)

Risk Profile:

Based on analysis framework, this client presents medium risk profile primarily driven by industry sector exposure and transaction complexity.

Key Risk Drivers Identified:

- Industry: Cryptocurrency sector carries inherent AML risks

- Transactions: Cross-border patterns warrant monitoring

- Documentation: Source of wealth documented but sector-specific risks remain

Mitigating Factors Noted:

- Strong source of wealth documentation provided

- Transparent business operations disclosed

- No PEP status or adverse media identified

- Comprehensive financial information available

Considerations for Your Assessment:

- Enhanced monitoring may be appropriate given sector risk

- Detailed documentation of cryptocurrency sources may be advisable

- Transaction pattern monitoring for unusual geographic concentrations

- Regular review cadence due to evolving regulatory landscape

ADVISOR ACTION REQUIRED:

- → Review this analysis in context of complete client relationship

- → Verify accuracy of identified risk factors

- → Assess whether additional factors should be considered

- → Apply your professional judgment

- → Make final AML risk assessment

- → Determine appropriate due diligence level

- → Document your determination and actions

Transparency Note:

- • AI-generated analysis clearly labeled as AI "ANALYSIS"

- • Provided for your consideration only

- • You determine whether analysis is accurate and appropriate

- • You make all AML risk and due diligence determinations

Separate AML Risk Documentation

What System Generates:

Confidential analysis report (separate from client reports) including:

- → Complete risk scoring breakdown

- → Dimension-by-dimension analysis

- → Suggested risk tier

- → AI-generated risk analysis

- → CDD/EDD considerations

- → Documentation for your AML file

Confidentiality:

- • Analysis is advisor/compliance-only

- • Not shared with clients

- • Supports your internal AML processes

- • Maintains confidentiality of risk assessments

Your Use:

- → Review for your risk assessment process

- → Support your CDD/EDD determination

- → Document in your AML compliance file

- → Use for internal risk management

- → Support supervisory review

- → Maintain for regulatory examinations

Your Documentation Requirements:

Beyond system analysis, you must document:

- → Your review of system analysis

- → Additional factors you considered

- → Your final risk assessment determination

- → Due diligence level determination

- → Actions taken or planned

- → Ongoing monitoring approach

- → Supervisory review and approval

Understanding AML Risk Assessment Tools and Your Responsibilities

What AML Risk Assessment Tools Provide:

- Structured risk analysis framework

- Multi-dimensional risk factor evaluation

- Risk scoring methodology

- Tier mapping suggestions

- AI-generated contextual analysis

- Documentation supporting your AML file

What AML Risk Assessment Tools Do NOT Provide:

- Final AML risk determinations

- Due diligence level decisions

- Compliance certifications

- Guarantee of complete risk identification

- Suspicious activity determinations

- Regulatory compliance assurance

- Elimination of advisor/compliance responsibility

IMPORTANT LEGAL NOTICE:

VelocityIQ provides AML risk assessment tools and analysis frameworks. VelocityIQ does not make AML risk determinations, determine due diligence requirements, or provide AML compliance services.

All AML risk assessments, due diligence determinations, suspicious activity identification, and AML/BSA compliance obligations must be fulfilled by licensed financial professionals and compliance officers who review system analysis, apply independent professional judgment, and take full responsibility for AML compliance.

System analysis is provided "as is" without warranties. VelocityIQ disclaims liability for AML risk assessments, due diligence determinations, compliance decisions, regulatory outcomes, or any damages arising from use of AML risk assessment tools.

Use of AML risk assessment tools does not ensure AML/BSA compliance, complete risk identification, appropriate due diligence, or eliminate advisor/firm liability for AML compliance.

Users must comply with all applicable AML/BSA regulations, maintain appropriate policies and procedures, conduct required due diligence, and fulfill all reporting obligations regardless of system analysis output.

AML Risk Assessment Framework Supporting Your Due Diligence Process

See how VelocityIQ's FinCEN-aligned risk assessment framework provides structured analysis across seven risk dimensions—supporting your professional judgment in making AML risk determinations and due diligence decisions.

VelocityIQ provides AML risk assessment tools. Advisors and compliance professionals make final risk determinations, due diligence decisions, and are solely responsible for AML/BSA compliance.